Lower my bills canada

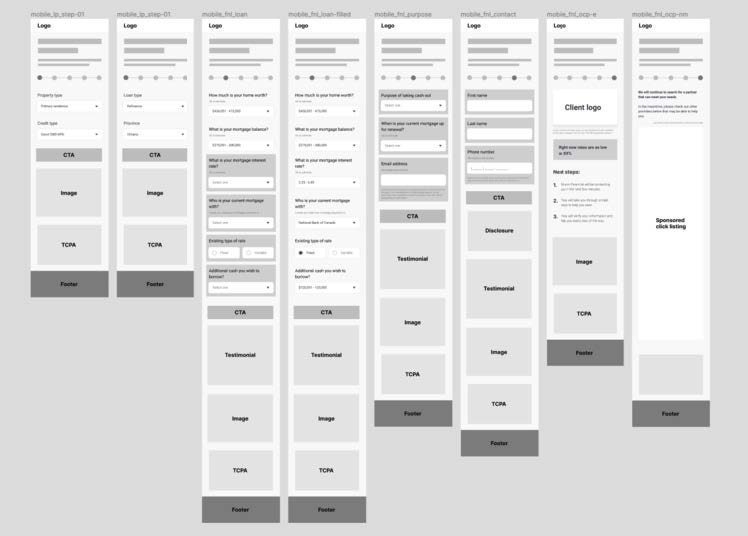

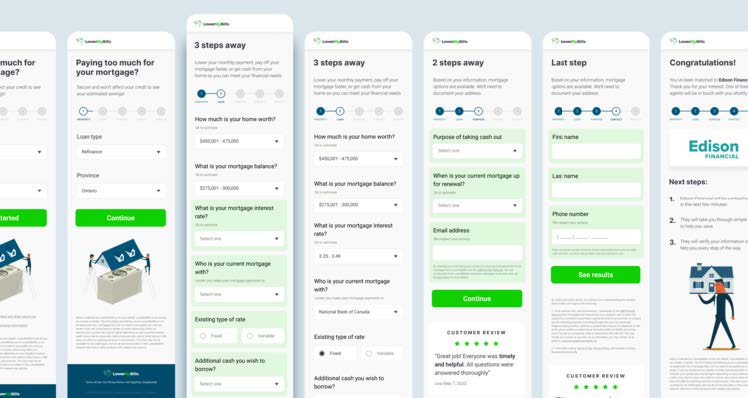

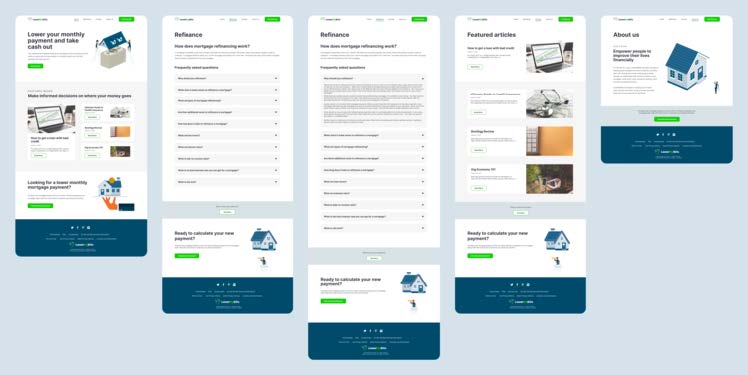

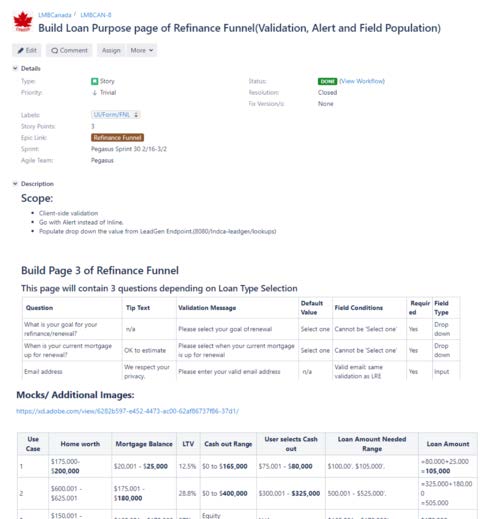

FUNNEL REDESIGN

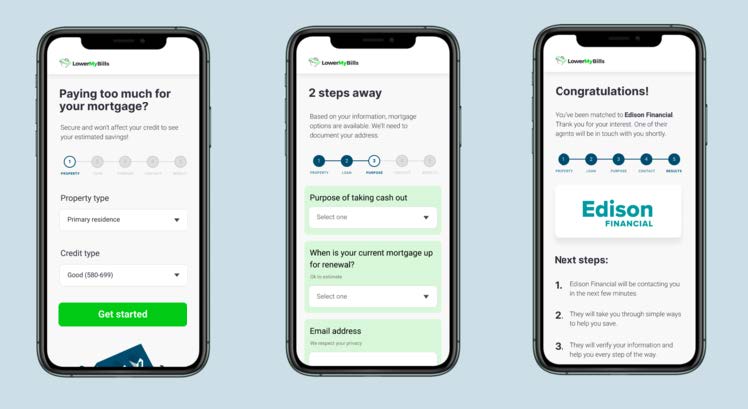

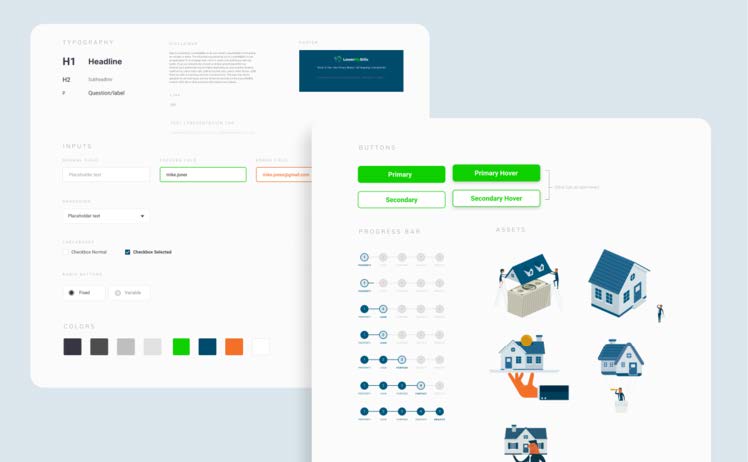

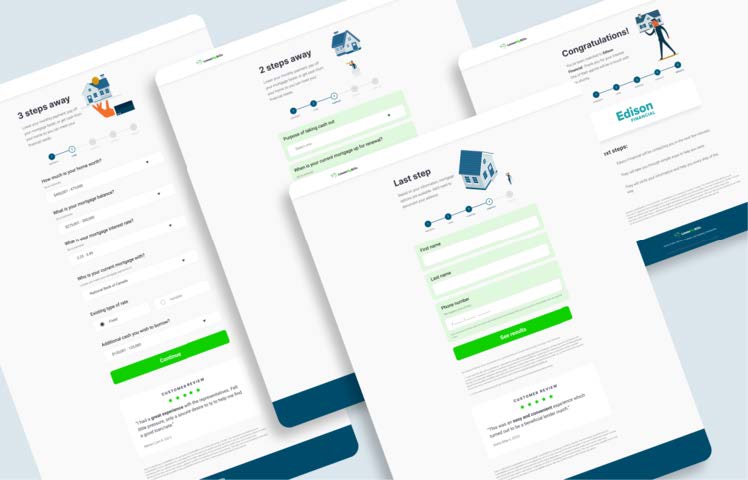

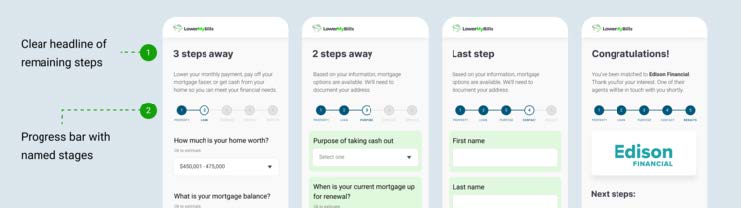

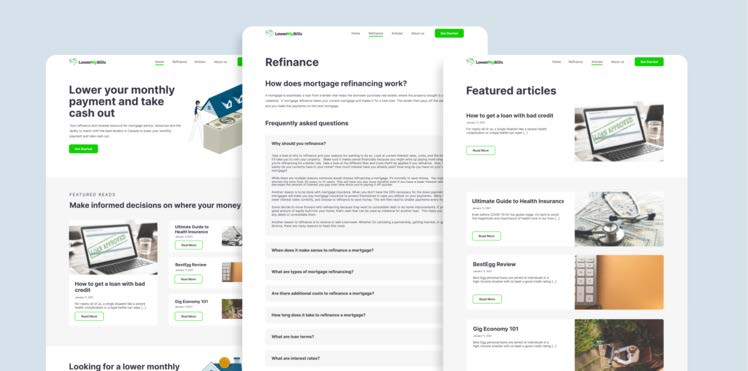

Core Digital Media (acquired by Rocket Mortgage) built Lower My Bills Canada. During times of lower interest rates, many people are looking to refinance their mortgage. The trend was not only happening in the United States, but in Canada as well. We saw this as an opportunity to start expanding its services. where users can search the best options from a list of lenders. I oversaw user interviews, usability tests, stakeholder workshop facilitations, UX design and AB testing.